property tax assistance program georgia

Help is only available for income qualified residents and they need to contact their local assessor Department of Revenue or county treasurer. Ad Download Or Email Form PT-50P More Fillable Forms Register and Subscribe Now.

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Mortgage Interest Rates

Program options are listed here we discuss Residential Transitional Property on page 65.

. New Yorks senior exemption is also pretty generous. Medicaid provides eligible individuals access to. Its calculated at 50 percent of your homes appraised value meaning youre only.

County Property Tax Facts. Treasurys Federal Emergency Rental Assistance Program to provide relief to individuals families and landlords whose finances have been negatively impacted since March 13 2020 the start of the COVID-19 pandemic. Ask for a Payment Plan Apply for a.

Hurricane Michael Disaster Assistance Grants- One-time grant program to assist Georgia historic property owners with recovery from Hurricane Michael 2018 by addressing historic property needs unmet through other funding sources. Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. Some programs allow the creation of property tax installment plans for property owners who are delinquent in paying taxes as a result of saying being unemployed for the last several months.

Any negotiated program will be effective after the local government officials have thoroughly reviewed the owners ability to pay and the request from. Property tax assistance program georgia Saturday March 5 2022 Edit Check Out This Great Article About Title Questions Thanks To Gillen Joachim For Sharing This Info Ga Realest Helpful Hints This Or That Questions Answers. Property Tax Returns and Payment.

In addition to certain rights landowners may also have alternatives for the manner in which value is determined. The property tax assistance program provides qualified low-income seniors with cash reimbursements for part of their property taxes. The State of Georgia received 989 million from US.

The funds will be used for rental and utility payments including other associated. With many people out of work due to the coronavirus COVID-19 pandemic the City Department of Finance DOF is offering several programs to assist property owners who are having a hard time making their property tax payments. Property taxes are due on property that was owned on January 1 for the current tax year.

If youre 62 years old or older and living within a school district and your annual family income is 10000 or less then up to 10000 of your. The law provides that. The property tax postponement program gives qualified seniors the option of having the state pay all or part of their property taxes until the individual moves sells the property or dies.

The basis for ad valorem taxation is the fair market value of the property which is established as of January 1 of each year. The Homeowner Assistance Fund program is available in each state and United States territories. When are Property Tax Returns Due.

Ad 2022 Homeowner Relief Program is Giving a One Time 3627 StimuIus Check. The Department of Community Affairs GHFA Affordable Housing Inc. Entrepreneur Small Business Loan Guarantee Program provides new financial programs for entrepreneurs and small businesses in rural Georgia.

Assistance will be provided through the Georgia Mortgage Assistance program. 25 for every 1000 of assessed value or 25 multiplied by 40 is 1000. GHFA was appointed the administrator of the federally funded program for the State of Georgia.

As of January 1 1992 owners of eligible land have three options for determining bare. Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. Ad Mortgage Relief Program is Giving 3708 Back to Homeowners.

In a county where the millage rate is 25 mills the property tax on that house would be 1000. Senior Citizen Exemptions From Georgia Property Tax If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax exemption. Property Tax Millage Rates.

Property Tax Incentives for the Georgia Landowner. The Supplemental Nutrition Assistance Program SNAP also known as food stamps provides monthly funds for families to purchase groceries. Owners of historic buildings structures and objects listed in or eligible for the National Register of Historic Places in Georgia counties designated.

The tax is levied on the assessed value of the property which by law is established at 40 of fair market value. Ad valorem tax more commonly known as property tax is a large source of revenue for local governments in Georgia. The amount may need to be paid ifwhen the home is ever sold in the future.

Property Taxes in Georgia. Also you may qualify for Clean Energy Property Tax Credits up to 35 or 100000 of the project cost. These include exemption programs to lower the amount of taxes owed standard payment plan options as well as the new Property Tax and Interest.

Click here PDF for key networks and funding sources. Check Your Eligibility Today. Property Tax Homestead Exemptions.

This statewide assistance program may allow up to one half of the annual property taxes to remain unpaid. While the exact programs available for back property tax help can vary by area a little research can help you determine any assistance for which you qualify.

What Is Tax Relief Homeowner Roofing Thunderstorms

I Want To Purchase A Duplex As Income Producing Property Before The End Of 2014 Maximum Mortgage 100k Month Mortgage Payoff Mortgage Brokers Mortgage Payment

Rent To Own Homes Nearby Snellville Ga Rent To Own Homes Franklin Homes Find Homes For Sale

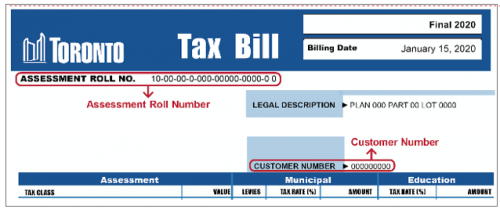

Tax And Utilities Answers City Of Toronto

Sales Tax Help And Faqs Tax Help Sales Tax Business Pages

Pin On Law And Legal Infographics

Georgia Relocation Guide Relocation House Hunting Real Estate

Your Voice At The Irs Tax Refund Tax Services Money Management

941 Payroll Tax Debt Help Dequincy La 70633 M M Financial Blog Tax Debt Payroll Taxes Irs Taxes

Hhawkins I Will Write A Press Release For 5 On Www Fiverr Com Writing A Press Release Press Release Writing

Your Voice At The Irs Tax Refund Tax Services Money Management

Wage Garnishment The Most Common Type Of Garnishment Is The Process Of Deducting Money From An Employee S Monetary Compensa Tax Attorney Irs Taxes Tax Lawyer

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota States

Property Taxes Haldimand County

Check Out This Great Article About Title Questions Thanks To Gillen Joachim For Sharing This Info Ga Realest Helpful Hints This Or That Questions Answers

A Guide To Hawaii State Sales Tax Sales Tax Filing Taxes Hawaii

Zurich Launches Global Business Platforms Unit To Expand Digital Services Worldwide Global Business Technology Solutions Media Relations